Itemized deduction

| Part of a series on Taxation |

| Taxation in the United States |

|---|

| Federal taxation |

| Authority · History Internal Revenue Service (Court • Forms • Code • Revenue) Taxpayer standing Income tax · Payroll tax Alternative Minimum Tax Estate tax · Excise tax Gift tax · Corporate tax Capital gains tax |

| State and local taxation |

| State income tax State tax levels Sales tax · Use tax Property tax Land value tax |

|

Taxation by country

|

An itemized deduction is an eligible expense that individual taxpayers in the United States can report on their federal income tax returns in order to decrease their taxable income.

Most taxpayers are allowed a choice between the itemized deductions and the standard deduction. After computing their adjusted gross income (AGI), taxpayers can itemize their deductions (from a list of allowable items) and subtract those itemized deductions (and any applicable personal exemption deductions) from their AGI amount to arrive at their taxable income amount. Alternatively, they can elect to subtract the standard deduction for their filing status (and any applicable personal exemption deduction) to arrive at their taxable income. In other words, the taxpayer may generally deduct the total itemized deduction amount, or the standard deduction amount, whichever is greater.

The choice between the standard deduction and itemizing involves a number of factors:

- Only a taxpayer eligible for standard deduction can choose it.

- U.S. citizens and resident aliens are eligible to take the standard deduction. Nonresident aliens are not eligible.

- If the taxpayer is filing as "married, filing separately", and his or her spouse itemizes, then the taxpayer cannot take the standard deduction. In other words, a taxpayer whose spouse itemizes deductions must either itemize as well, or claim "0" (zero) as the amount of the standard deduction.[1]

- The taxpayer must have maintained the records required to substantiate the itemized deductions.

- If the amounts of the itemized deductions and the standard deduction do not differ much, the taxpayer may take the standard deduction to reduce the possibility of adjustment by the Internal Revenue Service (IRS). The amount of standard deduction cannot be changed upon audit unless the taxpayer's filing status changes.

- If the taxpayer is otherwise eligible to file a shorter tax form such as 1040EZ or 1040A, he would prefer not to prepare (or pay to prepare) the more complicated Form 1040 and the associated Schedule A for itemized deductions.

Deductions are reported in the tax year in which the eligible expenses were paid. For example, an annual membership fee for a professional association paid in December 2009 for year 2010 is deductible in year 2009.

Contents |

Examples of allowable itemized deductions

There are a number of allowable deductions:

- Medical expenses, to the extent that the expenses exceed 7.5% of the taxpayer's AGI. (e.g., a taxpayer with an AGI of $20,000 and medical expenses of $5,000 would be eligible to deduct $3500 of their medical expenses ( 20,000 X .075 = 1500; 5000 - 1500 = 3500 ).) The 7.5% floor means that most taxpayers are unable to take advantage of the medical expense deduction. Allowable medical expenses include:

- Capital expenditures that are advised by a physician, where the facility is used primarily by the patient alone and the expense is reasonable (i.e. a swimming pool for someone with degenerative spinal disorder OR an elevator for someone with heart disease)

- Payments to doctors, dentists, surgeons, chiropractors, psychologists, counselors, physical therapists, osteopaths, podiatrists, home health care nurses, cost of care for chronic cognitive impairment

- Premiums for medical insurance (but not if paid by another, or with pre-tax money)

- Premiums for qualifying long-term-care insurance, depending on the taxpayer's age

- Payments for prescription drugs and insulin

- Payments for devices needed to treat or compensate for a medical condition (crutches, wheelchairs, prescription eyeglasses, hearing aids)

- Mileage for travel to and from doctors and medical treatment

- Necessary travel expenses

- Non-deductible medical expenses include:

- Over-the-counter medications

- Health club memberships (to improve general health & fitness)

- Cosmetic surgery (except to restore normal appearance after an injury or to treat a genetic deformity)

- State and local taxes paid, including:

- Income taxes (or, alternatively, state and local general sales taxes[2])

- Property taxes (assessed by reference to the value of the property)

- but not including:

- Mortgage interest expense on debt incurred in connection with up to two homes, subject to limits (up to $1,000,000 in purchase debt, or $100,000 in home equity loans)

- also, points paid to discount the interest rate on up to two homes; points paid upon acquisition are immediately deductible, but points paid on a refinance must be amortized (deducted in equal parts over the lifetime of the loan)

- also private mortgage insurance premiums through 2010

- Investment interest, up to the amount of income reported from investments (the balance is deferred until more investment income is declared)

- Charitable contributions to allowable recipients; this deduction is limited to either 30% or 50% of AGI, depending on the characterization of the recipient. Donations can be made as money, or in the form of goods. The value of donated services cannot be deducted as a contribution. Reasonable expenses necessary to provide donated services can, however, be deducted (such as mileage, special uniforms, or meals). Non-cash donations valued at more than $500 require special substantiation on a separate form. Non-cash donations are deductible at the lesser of the donor's cost or the current fair market value, unless the non-cash donation has been held for greater than a year (Long term), in which case it can be deducted at fair market value. Eligible recipients for charitable contributions include:

- Churches, synagogues, mosques, other houses of worship

- Federal, state, or local government entities

- Fraternal or veterans' organizations

Non-eligible recipients include:

-

- Individuals

- Political campaigns or political action committees (PACs)

- Casualty and theft losses, to the extent that they exceed 10% of the taxpayer's AGI (in aggregate), and $100 (per event, $500 starting tax year 2009)

- Gambling losses, but only to the extent of gambling income (For example, a person who wins $1,000 in various gambling activities during the tax year and loses $800 in other gambling activities can deduct the $800 in losses, resulting in net gambling income of $200. By contrast, a person who wins $3,000 in various gambling activities during the year and loses $3,500 in other gambling activities in that year can deduct only $3,000 of the losses against the $3,000 in income, resulting in a break-even gambling activity for tax purposes for that year -- with no deduction for the remaining $500 excess loss.)

Miscellaneous itemized deductions

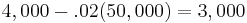

It is important to distinguish miscellaneous itemized deductions from other “normal” itemized deductions. The reason for this is because miscellaneous itemized deductions are subject to a 2% floor.[3] A taxpayer can only deduct the amount of miscellaneous itemized deductions that exceed 2% of their adjusted gross income. [4] For example, if a taxpayer has adjusted gross income of $50,000 with $4,000 in miscellaneous itemized deductions, the taxpayer can only deduct $3,000.

There are 12 deductions listed in 26 U.S.C. § 67(b). These are NOT miscellaneous itemized deductions, and thus not subject to the 2% floor (although they may have their own rules). Any deduction not found in section 67(b) is a miscellaneous itemized deduction.[5] Examples include:

- Job-related clothing or equipment, such as steel-toed boots, hardhats, uniforms (if they are not suited for social wear: suits and tuxedoes are not deductible, even if the taxpayer does not like to wear them, but nurses' and police uniforms are), tools and equipment required for work

- Union dues

- Unreimbursed work-related expenses, such as travel or education (so long as the education does not qualify the taxpayer for a new line of work; law school, for example, is not deductible.)

- Fees paid to tax preparers, or to purchase books or software used to determine and calculate taxes owed

- Subscriptions to newspapers or other periodicals directly relating to your job[6]

Limitations

If the taxpayer's adjusted gross income is above a threshold (or "applicable amount"), then the total allowable itemized deductions is reduced by 1/3 of the lesser of

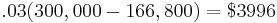

- 3% of the excess of adjusted gross income over $166,800; or

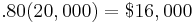

- 80% of the total itemized deductions otherwise allowable[7]

In 2009, the threshold adjusted gross income is $166,800 ($83,400 if married filing separately).

So, for example, if your adjusted gross income is $300,000 and you have $20,000 in itemized deductions, first figure out 3% of the excess above $166,800:

Then figure out 80% of the total deductions

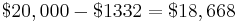

Finally, determine which value is lesser, then take 1/3 of this value. In this instance, the lesser value is $3996 so the taxpayer's total itemized deductions shall be reduced by $3996 divided by 3, or $1332. This means out of the $20,000 itemized deductions claimed, only $18668 will be allowed.

Even though the Internal Revenue Code sets the applicable amount at $100,000, that amount is subject to inflation.[8] Therefore, you must double check the Consumer Price Index for the applicable amount for the current year.

In addition, this limitation on itemized deductions is applied after any other limitation.[9] This means that you first need to figure out the total allowable miscellaneous itemized deductions, etc., before determining any limits on the total amount of deductions.

Phaseout

This limitation of itemized deductions has been "phased out."[10] For taxable years 2006 and 2007, the amount was reduced to 2/3 of the limitation, and for taxable years 2008 and 2009, the amount was reduced to 1/3 of the limitation. This "phase out" was completed on January 1, 2010.[4]